Business Insurance in and around Statesboro

Calling all small business owners of Statesboro!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Whether you own a a fabric store, a window treatment store, or an antique store, State Farm has small business coverage that can help. That way, amid all the various decisions and options, you can focus on making this adventure a success.

Calling all small business owners of Statesboro!

Helping insure small businesses since 1935

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, business owners policies or commercial auto.

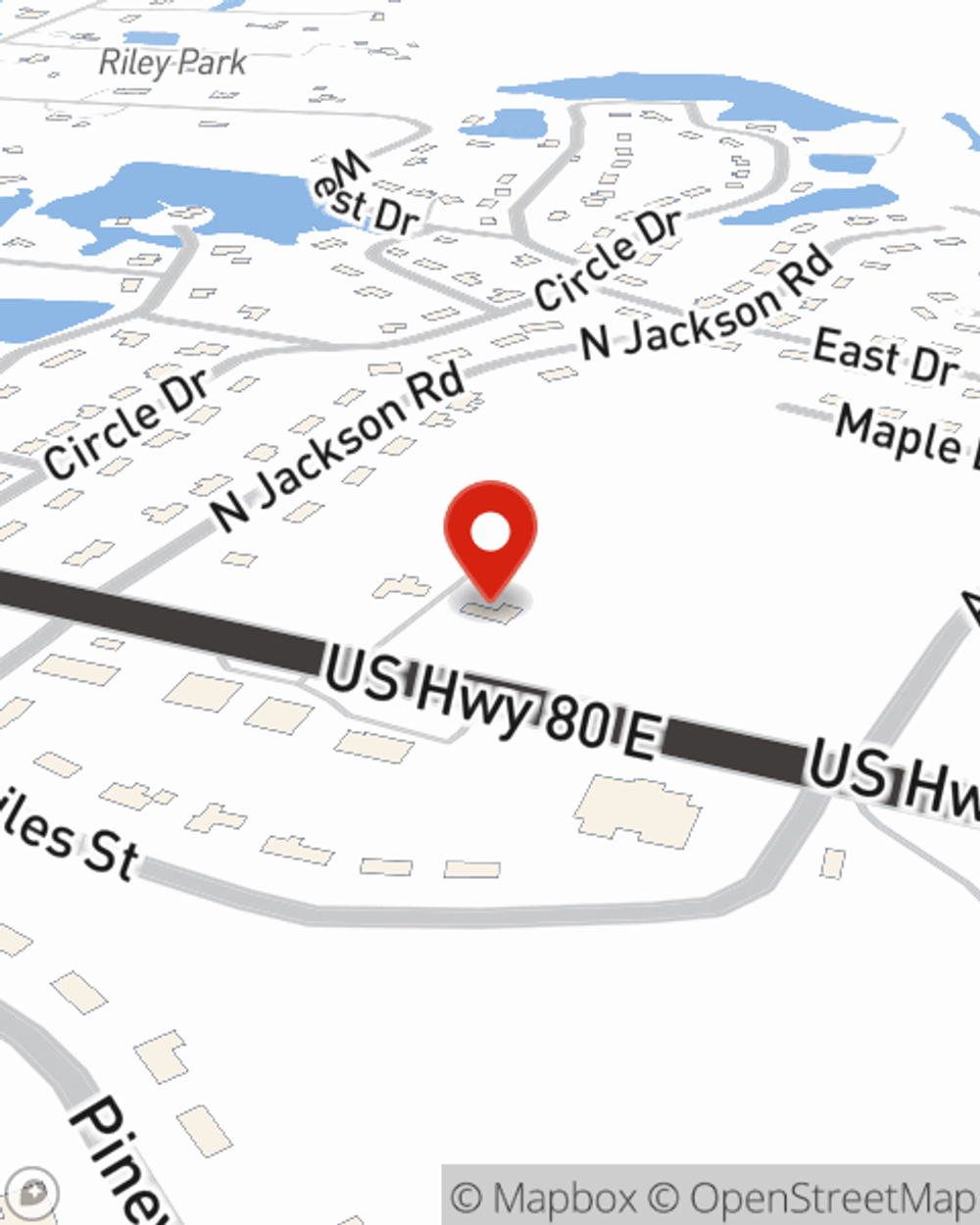

The right coverages can help keep your business safe. Consider visiting State Farm agent Ginger Larrabee's office today to explore your options and get started!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Ginger Larrabee

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.